As investors worldwide shift away from short-lived speculation and begin prioritizing long-term value and

fundamental stability, CanPeak Resources has emerged as a notable option for those seeking

exposure to Canada’s thriving resource-driven economy. With its foundation in real industries such as mining,

energy, infrastructure development, and commodity-based markets, the platform positions itself as a reliable,

strategically structured investment alternative.

In this CanPeak Resources Review 2025, we break down everything the platform offers — including its

investment model, advantages, potential risks, core features, and whether it appears to be a trustworthy option

for long-term investors.

What is CanPeak Resources?

CanPeak Resources is a long-term investment platform built around Canada’s most important real-sector

industries. The platform grants everyday investors access to opportunities typically limited to large institutions

or accredited professionals. These opportunities include:

— metals and mineral extraction;

— energy production and renewable development;

— national infrastructure and transportation systems;

— industrial growth and supply-chain expansion;

— commodity-driven sectors with global export demand.

By focusing on asset-backed industries instead of speculative markets, CanPeak Resources aims to help users

develop portfolios grounded in real economic output.

Key Features of CanPeak Resources

Several characteristics set CanPeak Resources apart from traditional trading platforms or high-risk automated systems.

Full Exposure to Canada’s Resource Strength

Canada remains one of the world’s leading nations in resource production — including metals, minerals, energy,

and sustainable development initiatives. CanPeak’s investment model mirrors these strengths, offering

investors an opportunity to benefit from nationwide growth.

Stable, Fundamentals-Based Investment Model

Instead of chasing unpredictable price movements, users invest in long-term development cycles driven by

real demand, infrastructure, and industrial output.

Beginner-Friendly Guidance and Clear Structure

The platform simplifies complex industries by offering:

— onboarding assistance;

— investment explanations;

— support for interpreting market sectors;

— help choosing a suitable investment pathway.

Diversification Across Multiple Industries

This reduces upstream risk and allows portfolio performance to remain balanced even when certain sectors

experience temporary slowdowns.

CanPeak Resources Advantages Overview

| Advantage | Description | Investor Benefit |

|---|---|---|

| Real-Sector Investment | Funds allocated to industries that produce physical output | Lower volatility and long-term reliability |

| Multi-Industry Diversification | Participation in mining, energy, infrastructure and commodities | Less risk compared to single-sector investing |

| Beginner Support | Onboarding assistance and structured explanations | Helps new investors feel confident and informed |

| Low Minimum Entry | Accessible starting amount for most investors | Allows gradual long-term portfolio growth |

| Long-Term Growth Focus | Designed around multi-year investment cycles | Suitable for sustainable wealth-building |

How CanPeak Resources Works

Despite focusing on complex Canadian industries, the platform follows a streamlined five-step investment model.

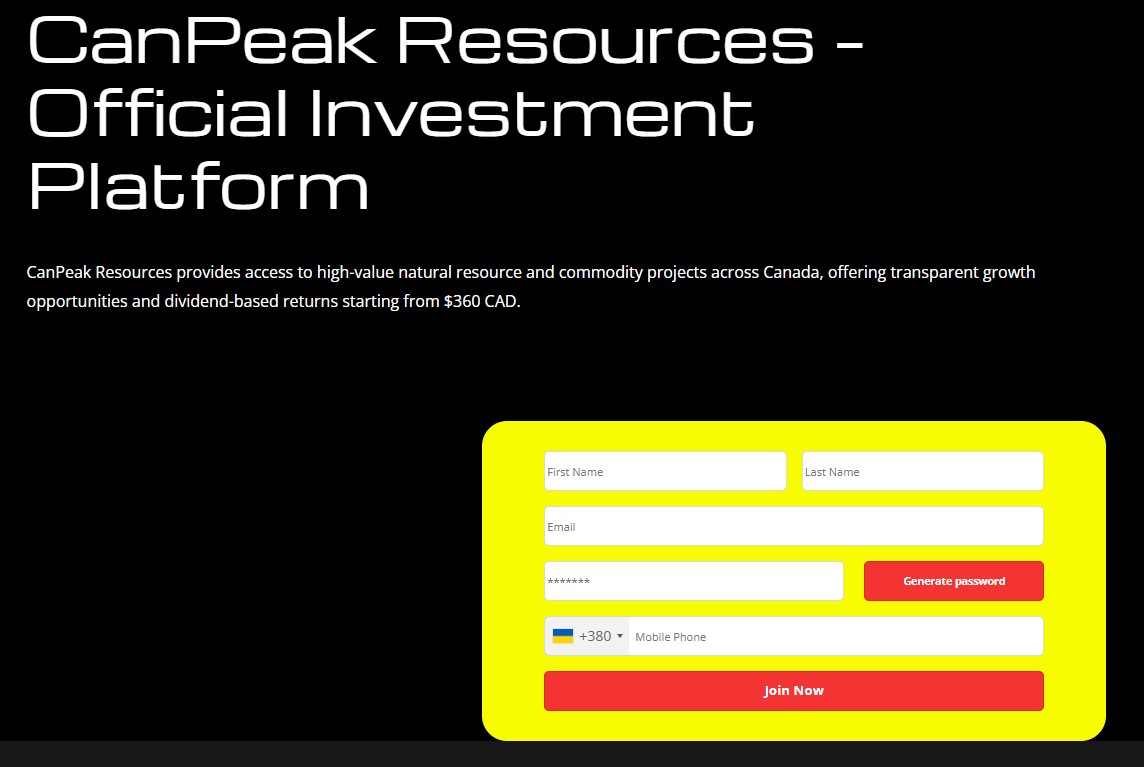

1. Account Creation

Registration unlocks the dashboard and provides users with access to educational materials and support.

2. Verification Process

Verification ensures compliance with investment regulations and creates a secure user environment.

3. Funding Your Portfolio

After verification, users deposit funds. The platform keeps the minimum entry amount accessible, making it

beginner-friendly.

4. Allocation Into Canadian Industries

Users receive exposure to different sectors depending on their investment goals and risk preferences.

Guidance is available for those unsure which direction to choose.

5. Long-Term Monitoring and Development

Investors track global demand cycles, economic trends, and portfolio performance as Canada’s resource sectors grow.

Pros & Cons

- 🪵 Stable, asset-backed investment model rooted in real Canadian industries.

- 🪵 Multiple sectors included, reducing dependency on a single market.

- 🪵 Beginner-friendly guidance helps users understand complex industries.

- 🪵 Low entry requirement makes it accessible to cautious or first-time investors.

- 🪵 Designed for long-term performance rather than speculative trading.

- ⚠️ No guaranteed profits — even resource markets fluctuate with global trends.

- ⚠️ Not suitable for short-term traders due to its long-term structure.

- ⚠️ Documentation must be reviewed carefully — investors should always check terms.

Is CanPeak Resources Legit?

While all investments come with risk, several signs indicate that CanPeak Resources follows a structured,

long-term, fundamentals-based approach rather than a speculative or unrealistic model.

Positive legitimacy indicators:

— investment tied to real sectors, not artificial price movements;

— onboarding guidance and risk transparency;

— diversified industrial exposure;

— clear long-term orientation with no exaggerated claims.

However, users should always conduct basic due diligence, especially when investing in sectors tied to global

cycles. Reviewing documents, understanding timelines, and managing expectations is essential.

FAQ

What industries does CanPeak Resources invest in?

The platform focuses on mining, energy, infrastructure, and commodity-driven Canadian sectors.

Is the platform good for beginners?

Yes — onboard assistance and structured explanations make it accessible even for users with no experience.

Does CanPeak promise fixed returns?

No. The platform emphasizes risk awareness and long-term expectations, without promising guaranteed profits.

How much do I need to start investing?

CanPeak Resources generally allows users to begin with a low entry threshold, making it easy to start small.

Is CanPeak Resources more suitable for short-term or long-term investing?

It is designed specifically for long-term, fundamentals-based investment rather than fast, speculative trading.

Leave A Comment